Navigating the world of auto insurance can be confusing, especially when it comes to understanding the Required Auto Insurance In New York. In New York, having the right insurance isn’t just a good idea—it’s the law. Whether you’re a new driver in the Empire State or a seasoned motorist looking to brush up on the rules. Knowing the specifics of required insurance is vital. This article will break down New York’s mandatory insurance laws. Also, the types of coverage you must have, the minimum coverage limits, and the penalties you could face if you’re not properly insured.

Understanding Mandatory Insurance Laws in New York

New York State takes insurance requirements seriously to ensure that all drivers are financially responsible in the event of an accident. The law mandates that every registered vehicle be insured at all times. Even if it’s not being actively enforced, the New York Department of Motor Vehicles (DMV) strictly enforces this rule, and proof of insurance must be provided when you register or renew your vehicle registration.

The rationale behind these strict laws is to protect not just the drivers. But also pedestrians and other road users from the financial fallout of accidents. Liability insurance is the cornerstone of this system, ensuring that accident victims can recover damages and costs. Without such laws, individuals injured by uninsured drivers could be left to cover expensive medical bills and property damage.

In addition to requiring insurance, New York is a “no-fault” state. This means that after most accidents, your own insurance covers your medical expenses and lost wages, regardless of who caused the accident. The aim is to reduce litigation and provide timely compensation to accident victims, but it further underscores the importance of carrying the required insurance at all times. Understanding the Required Auto Insurance In New York is essential.

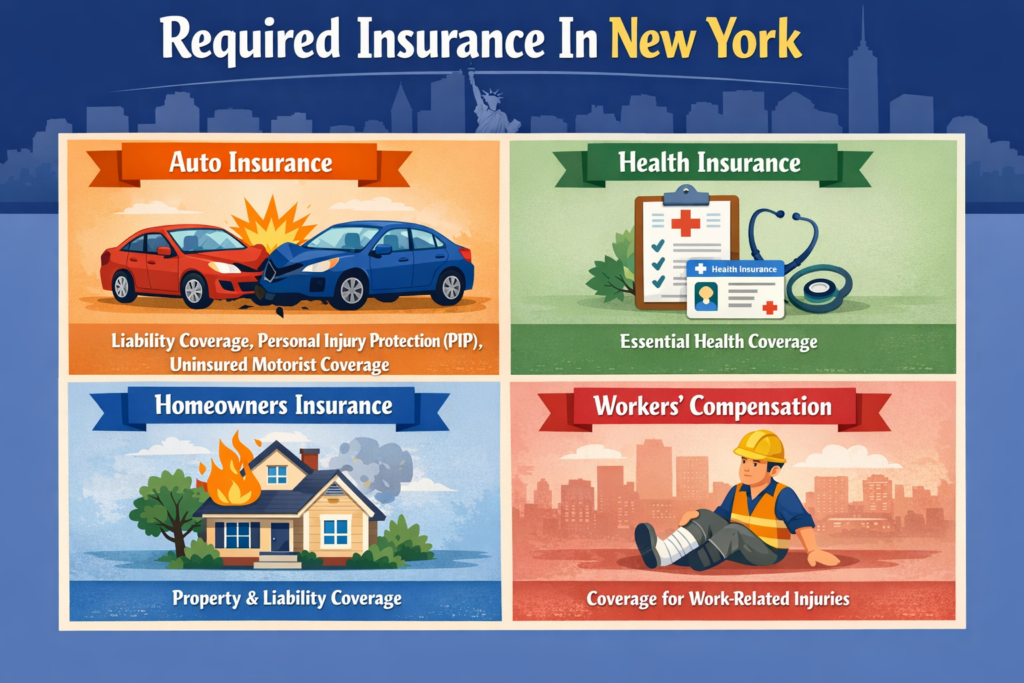

Types of Insurance Required for New York Drivers

The primary type of insurance required is liability coverage, which pays for bodily injuries and property damage suffered by others in an accident you cause. This is the foundation of New York’s mandatory insurance. However, as a no-fault state, New York also requires drivers to carry Personal Injury Protection (PIP), also known as “no-fault insurance.” PIP covers medical expenses and lost income for you and your passengers, regardless of fault.

Additionally, uninsured motorists coverage is mandatory in New York. This protects you if you’re involved in an accident with an at-fault driver who has no insurance or is underinsured. In such cases, your own insurance steps in to cover your damages, ensuring you’re not left unprotected.

While comprehensive and collision coverage are not required by New York law, they are often recommended for added protection. These optional coverages pay for damage to your own vehicle from a variety of causes, such as theft, vandalism, or single-car accidents. However, to legally drive in New York, you only need liability, PIP, and uninsured motorist coverage.

Minimum Coverage Limits and Policy Requirements

New York law specifies minimum coverage limits for each required type of insurance. For liability insurance, you must have at least $25,000 for bodily injury per person, $50,000 for bodily injury per accident, and $10,000 for property damage per accident. These are often referred to as 25/50/10 coverage. These limits ensure that some compensation is available to victims in most accidents.

For Personal Injury Protection, New York requires a minimum of $50,000 in coverage per person per accident. This amount is designed to cover reasonable medical expenses, lost earnings up to a certain amount, and other reasonable and necessary expenses, such as rehabilitation or funeral costs.

Uninsured motorist coverage must match the minimum liability coverage—$25,000 per person and $50,000 per accident for injuries. It’s important to remember that these are just minimums. Many drivers choose higher limits for greater financial protection. Also, insurance policies must be issued by companies licensed by the New York State Department of Financial Services. Thus ensuring regulatory oversight and consumer protection.

Penalties for Lacking Required Insurance in New York

Driving without the Required Auto Insurance In New York is a serious offense with significant consequences. The DMV is automatically notified if your insurance lapses or is canceled. And your vehicle registration and driver’s license may be suspended if valid coverage isn’t maintained. Even a short coverage gap can trigger penalties.

If you’re caught driving without insurance, expect heavy fines, which can increase if you’ve been uninsured for an extended period. First-time offenders may face fines of up to $1,500, surcharges, and, in severe cases, jail time. Additionally, your vehicle may be impounded. You may be charged fees to have your license and registration reinstated.

Beyond the immediate legal and financial penalties, being uninsured leaves you vulnerable to lawsuits and out-of-pocket payments for damages arising from accidents. Insurance isn’t just a legal requirement. It’s essential for your financial security and peace of mind on New York’s busy roads.

Conclusion On Required Auto Insurance In New York

Staying informed about New York’s required auto insurance isn’t just about following the law—it’s about ensuring you’re protected in every situation. By understanding the types and minimum coverage limits, maintaining an active policy with a licensed insurer, and recognizing the risks of going uninsured, you can drive confidently and responsibly.